Individual Taxes - Filing Status - Head of Household

Head of Household

You may be able to file as head of household if you meet all the following requirements.

- You are

- unmarried or

- considered unmarried

on the last day of the year. See Marital Status , earlier, andConsidered Unmarried , later.

You paid more than half the cost of keeping up a home for the year.

A qualifying person lived with you in the home for more than half the year (except for temporary absences, such as school).

However, if the qualifying person is your dependent parent, he or she doesn’t have to live with you. See Special rule for parent , later, under Qualifying Person.

.

How to file.

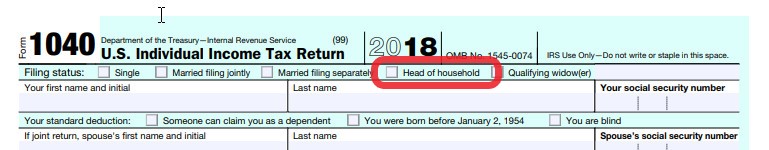

Indicate your choice of this filing status by checking the “Head of household” box on the Filing statusline at the top of Form 1040. If the child who qualifies you for this filing status isn’t claimed as your dependent in the Dependents section of Form 1040, enter the child’s name in the entry space at the far right of the filing status checkboxes (next to “Qualifying Widow(er)”). Use the Head of a household column of the Tax Table or Section D of the Tax Computation Worksheet to figure your tax.

.

Considered Unmarried

To qualify for head of household status, you must be either unmarried or considered unmarried on the last day of the year. You are considered unmarried on the last day of the tax year if you meet all the following tests.

You file a separate return. A separate return includes a return claiming married filing separately, single, or head of household filing status.

You paid more than half the cost of keeping up your home for the tax year.

Your spouse didn’t live in your home during the last 6 months of the tax year. Your spouse is considered to live in your home even if he or she is temporarily absent due to special circumstances. See Temporary absences , later.

Your home was the main home of your child, stepchild, or foster child for more than half the year. (See Home of qualifying person , later, for rules applying to a child’s birth, death, or temporary absence during the year.)

You must be able to claim the child as a dependent. However, you meet this test if you can’t claim the child as a dependent only because the noncustodial parent can claim the child using the rules described later inChildren of divorced or separated parents (or parents who live apart) under Qualifying Child or in Support Test for Children of Divorced or Separated Parents (or Parents Who Live Apart) under Qualifying Relative. The general rules for claiming a child as a dependent are explained later under Dependents .

If you were considered married for part of the year and lived in a community property state (listed earlier under Married Filing Separately), special rules may apply in determining your income and expenses. See Pub. 555 for more information.

Nonresident alien spouse.

You are considered unmarried for head of household purposes if your spouse was a nonresident alien at any time during the year and you don’t choose to treat your nonresident spouse as a resident alien. However, your spouse isn’t a qualifying person for head of household purposes. You must have another qualifying person and meet the other tests to be eligible to file as head of household.

Choice to treat spouse as resident.

You are considered married if you choose to treat your spouse as a resident alien. See chapter 1 of Pub. 519.

Keeping Up a Home

To qualify for head of household status, you must pay more than half of the cost of keeping up a home for the year. You can determine whether you paid more than half of the cost of keeping up a home by using Worksheet 1.

Worksheet 1. Cost of Keeping Up a Home

| Amount You Paid | Total Cost | |

| Property taxes | $ | $ |

| Mortgage interest expense | ||

| Rent | ||

| Utility charges | ||

| Repairs/maintenance | ||

| Property insurance | ||

| Food eaten in the home | ||

| Other household expenses | ||

| Totals | $ | $ |

| Minus total amount you paid | () | |

| Amount others paid | $ | |

| If the total amount you paid is more than the amount others paid, you meet the requirement of paying more than half the cost of keeping up the home. | ||

Costs you include.

Include in the cost of keeping up a home expenses such as rent, mortgage interest, real estate taxes, insurance on the home, repairs, utilities, and food eaten in the home.

Costs you don’t include.

Don’t include the cost of clothing, education, medical treatment, vacations, life insurance, or transportation. Also, don’t include the rental value of a home you own or the value of your services or those of a member of your household.

Qualifying Person

See Table 4 to see who is a qualifying person. Any person not described in Table 4 isn’t a qualifying person.

Example 1—child.

Your unmarried son lived with you all year and was 18 years old at the end of the year. He didn’t provide more than half of his own support and doesn’t meet the tests to be a qualifying child of anyone else. As a result, he is your qualifying child (see Qualifying Child , later) and, because he is single, your qualifying person for head of household purposes.

Example 2—child who isn’t qualifying person.

The facts are the same as in Example 1 except your son was 25 years old at the end of the year and his gross income was $5,000. Because he doesn’t meet the age test (explained later under Qualifying Child), your son isn’t your qualifying child. Because he doesn’t meet the gross income test (explained later under Qualifying Relative), he isn’t your qualifying relative. As a result, he isn’t your qualifying person for head of household purposes.

Example 3—girlfriend.

Your girlfriend lived with you all year. Even though she may be your qualifying relative if the gross income and support tests (explained later) are met, she isn’t your qualifying person for head of household purposes because she isn’t related to you in one of the ways listed under Relatives who don’t have to live with you . See Table 4.

Example 4—girlfriend’s child.

The facts are the same as in Example 3 except your girlfriend’s 10-year-old son also lived with you all year. He isn’t your qualifying child and, because he is your girlfriend’s qualifying child, he isn’t your qualifying relative (see Not a Qualifying Child Test , later). As a result, he isn’t your qualifying person for head of household purposes.

Home of qualifying person.

Generally, the qualifying person must live with you for more than half of the year.

Special rule for parent.

If your qualifying person is your father or mother, you may be eligible to file as head of household even if your father or mother doesn’t live with you. However, you must be able to claim your father or mother as a dependent. Also, you must pay more than half the cost of keeping up a home that was the main home for the entire year for your father or mother.

If you pay more than half the cost of keeping your parent in a rest home or home for the elderly, that counts as paying more than half the cost of keeping up your parent’s main home.

Death or birth.

You may be eligible to file as head of household even if the qualifying person who qualifies you for this filing status is born or dies during the year. To qualify you for head of household filing status, the qualifying person (as defined in Table 4) must be one of the following.

Your qualifying child or qualifying relative who lived with you for more than half the part of the year he or she was alive.

Your parent for whom you paid, for the entire part of the year he or she was alive, more than half the cost of keeping up the home he or she lived in.

Example.

You are unmarried. Your mother, who you claim as a dependent, lived in an apartment by herself. She died on September 2. The cost of the upkeep of her apartment for the year until her death was $6,000. You paid $4,000 and your brother paid $2,000. Your brother made no other payments toward your mother’s support. Your mother had no income. Because you paid more than half of the cost of keeping up your mother’s apartment from January 1 until her death, and you can claim her as a dependent, you can file as head of household.

Temporary absences.

You and your qualifying person are considered to live together even if one or both of you are temporarily absent from your home due to special circumstances such as illness, education, business, vacation, military service, or detention in a juvenile facility. It must be reasonable to assume the absent person will return to the home after the temporary absence. You must continue to keep up the home during the absence.

Kidnapped child.

You may be eligible to file as head of household even if the child who is your qualifying person has been kidnapped. You can claim head of household filing status if all the following statements are true.

The child is presumed by law enforcement authorities to have been kidnapped by someone who isn’t a member of your family or the child’s family.

In the year of the kidnapping, the child lived with you for more than half the part of the year before the kidnapping.

In the year of the child’s return, the child lived with you for more than half the part of the year following the date of the child’s return.

You would have qualified for head of household filing status if the child hadn’t been kidnapped.

This treatment applies for all years until the earlier of:

Table 4. Who Is a Qualifying Person Qualifying You To File as Head of Household?1

| See the text of this publication for the other requirements you must meet to claim head of household filing status. | ||||

| IF the person is your . . . | AND . . . | THEN that person is . . . | |||

| qualifying child (such as a son, daughter, or grandchild who lived with you more than half the year and meets certain other tests)2 | he or she is single | a qualifying person, whether or not the child meets the Citizen or Resident Test. | |||

| he or she is married and you can claim him or her as a dependent | a qualifying person. | ||||

| he or she is married and you can’t claim him or her as a dependent | not a qualifying person.3 | ||||

| qualifying relative4 who is your father or mother | you can claim him or her as a dependent5 | a qualifying person.6 | |||

| you can’t claim him or her as a dependent | not a qualifying person. | ||||

| qualifying relative4 other than your father or mother (such as a grandparent, brother, or sister who meets certain tests). | he or she lived with you more than half the year, andhe or she is related to you in one of the ways listed under Relatives who don’t have to live with you , later, and you can claim him or her as a dependent5 | a qualifying person. | |||

| he or she didn’t live with you more than half the year | not a qualifying person. | ||||

| he or she isn’t related to you in one of the ways listed under Relatives who don’t have to live with you , later, and is your qualifying relative only because he or she lived with you all year as a member of your household | not a qualifying person. | ||||

| you can’t claim him or her as a dependent | not a qualifying person. | ||||

| 1 A person can’t qualify more than one taxpayer to use the head of household filing status for the year. | |||||

| 2 The term qualifying child is defined under Dependents, later. Note: If you are a noncustodial parent, the term “qualifying child” for head of household filing status doesn’t include a child who is your qualifying child only because of the rules described under Children of divorced or separated parents (or parents who live apart) under Qualifying Child, later. If you are the custodial parent and those rules apply, the child generally is your qualifying child for head of household filing status even though the child isn’t a qualifying child you can claim as a dependent. | |||||

| 3 This person is a qualifying person if the only reason you can’t claim them as a dependent is that you, or your spouse if filing jointly, can be claimed as a dependent on someone else’s return. | |||||

| 4 The term qualifying relative is defined under Dependents, later. | |||||

| 5 If you can claim a person as a dependent only because of a multiple support agreement, that person isn’t a qualifying person. See Multiple Support Agreement . | |||||

| 6 See Special rule for parent . | |||||