IL business must provide a qualified retirement plan such as 401k or enroll with Illinois Secure Choice

IL - New Mandatory Requirement

IL Secure Choice

In early 2018, Illinois launched a pilot for Illinois Secure Choice, a state-sponsored retirement program. This new, simple way to save for retirement provides a Roth Individual Retirement Arrangement (IRA) to those employees who do not have access to a retirement savings plan through work.

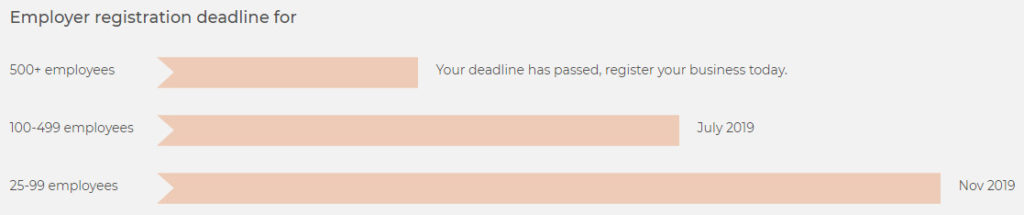

Secure Choice offers Illinois businesses with at least 25 employees, that have been in business for two or more years, and who do not currently provide a qualified savings plan the option to either offer a private market savings vehicle, or automatically enroll their employees into Secure Choice.

Secure Choice participants will be enrolled in a default target date Roth IRA with a default five percent payroll deduction, but could choose to change their contribution level or fund option at any time, or choose to opt-out of the program altogether. Accounts are owned by individual participants and will be portable from job-to-job.

2018 Earned Income Credit (EIC) Table

2018 Earned Income Credit (EIC) Table 2018 Earned Income Credit (EIC) TableCaution. This is not a tax table. 1. To find your credit, read down the “At least – But less than” columns and find the line that includes the amount you were told to look up from your EIC Worksheet. 2. Then, go to

Elementor #501

IL Secure Choice FAQ What is Secure Choice? The Illinois Secure Choice Savings Program is a retirement savings vehicle for private sector workers in Illinois that do not have access to an employer-sponsored plan. Secure Choice enables workers to save their own money easily and safely through a regular payroll deduction, and doesn’t burden employers with administrative or

Don’t be victim to a ‘ghost’ tax return preparer

Today, towards the end of the second full week of the 2019 tax filing season, the Internal Revenue Service warned taxpayers to avoid unethical tax return preparers, known as ghost preparers. By law, anyone who is paid to prepare or assist in preparing federal tax returns must have a valid 2019 Preparer Tax Identification Number,

Individuals who need passports for imminent travel should contact IRS promptly to resolve tax debt

The Internal Revenue Service today reiterated its warning that taxpayers may not be able to renew a current passport or obtain a new passport if they owe federal taxes. To avoid delays in travel plans, taxpayers need to take prompt action to resolve their tax issues. In January of last year, the IRS began implementing

Cash payment report helps government combat money laundering

Federal law requires a person to report cash transactions of more than $10,000 by filing IRS Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business. The information on the form helps law enforcement combat money laundering, tax evasion, drug dealing, terrorist financing and other criminal activities. Who is covered By law,

Be Tax Ready – understanding tax reform changes affecting individuals and families

The Tax Cuts and Jobs Act (TCJA), enacted in late 2017, produced the most sweeping tax law change in more than 30 years. The TCJA, often referred to as tax reform, affects nearly every taxpayer — and the 2018 federal return they’ll file in 2019. For taxpayers preparing to file their 2018 tax return or